Multiple Choice

Cars and Trucks Limited owns an engine testing machine which was purchased for $120,000.After 3 years of use the machine had accumulated depreciation of $58,560 but was revalued to $80,000.Two years later the machine was sold for $60,000 and had accumulated depreciation at the time of sale of $36,800.What journal entries would be required to record the sale of the machine in accordance with AASB 116 requirements?

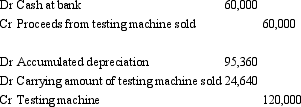

A)

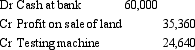

B)

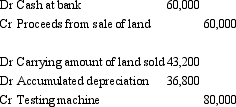

C)

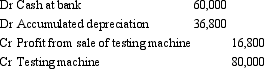

D)

E) None of the given answers.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Once an entity elects to value a

Q14: Research using the Positive Accounting Theory approach

Q15: AASB 116 permits the following with respect

Q16: Under AASB 116 when an asset is

Q17: AASB 116 provides guidance on fair values

Q18: Brown,Izan and Loh (1992)found that revaluations are

Q20: Manchester Ltd has a building that originally

Q22: A machine purchased by White Ltd had

Q24: Which of the following statement is true

Q34: If an asset is subject to depreciation