Multiple Choice

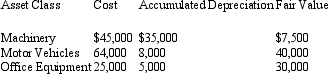

Palm Beach Ltd has elected to adopt the allowed alternative treatment to account for some of its property,plant and equipment.The information available for the class of assets the entity wishes to covert to revaluation model follows:  Which of the following statements are correct if Palm Beach Ltd is to comply with AASB 116?

Which of the following statements are correct if Palm Beach Ltd is to comply with AASB 116?

A) When office equipment is revalued, net profit will increase $10,000.

B) When machinery is revalued, net profit will increase by $2,500.

C) When motor vehicles are revalued, net profit will decrease by $16,000.

D) When all assets are revalued, net profit will increase by $8,500.

E) When all assets are revalued, net profit will decrease by $18,500 and asset revaluation reserve is increased by 8,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: AASB 116 requires that where the replacement

Q39: The process of discounting future cash flows

Q40: The costs associated with revaluing assets include:<br>A)

Q41: Revaluations increments are often a source of

Q44: Hendersons Ltd has just begun to revalue

Q45: Positive accounting theory suggests that the revalution

Q46: Which of the following statements is a

Q47: Purple Co Ltd purchased an item of

Q59: Australia is the only country that allows

Q73: AASB 116 requires that revaluation increments and