Essay

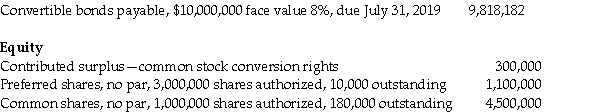

LMN Company reported the following amounts on its balance sheet at July 31,2019:

Liabilities

Additional information

Additional information

1.The bonds pay interest each July 31.Each $1,000 bond is convertible into 5 common shares.The bonds were originally issued to yield 10%.On July 31,2019,all the bonds were converted after the final interest payment was made.LMN uses the book value method to record bond conversions as recommended under IFRS.

2.No other share or bond transactions occurred during the year.

Required:

a.Prepare the journal entry to record the bond interest payment on July 31,2019.

b.Calculate the total number of common shares outstanding after the bonds' conversion on July 31,2019.

c.Prepare the journal entry to record the bond conversion.

Correct Answer:

Verified

_TB1321_00...

_TB1321_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: A company issues convertible bonds with face

Q11: Give 4 examples of cash flow hedges:

Q20: List three common stock compensation plans and

Q23: What is a "hedge"?<br>A)A financial instrument that

Q24: Assume that Signh agrees to purchase US$100,000

Q27: A company issued 100,000 preferred shares and

Q31: On January 1,2018 Taffy Inc.granted 210,000 stock

Q46: A company had a debt-to-equity ratio of

Q48: Which statement best explains the accounting for

Q67: On December 15, a company enters into