Essay

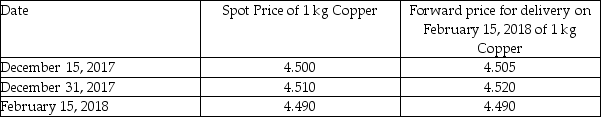

On December 15,2017 Welders Inc.signed a contract to sell 200,000 kg of copper pipes to be delivered on February 15,2018.Terms of sale were COD (cash on delivery).Welders,which has a December 31 year-end,entered into a two months forward agreement to sell the copper to mitigate its price change risk.Welders designated the forward as a fair value hedge.Pertinent commodity prices follow:

Required:

Required:

Record the required journal entries for December 15,December 31,and February 15 using the net method.If no entries are required,state "no entry required" and indicate why.

Correct Answer:

Verified

_TB1321_00...

_TB1321_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Which of the following is correct regarding

Q23: How would the liability portion of the

Q25: What is a "call" option?<br>A)A contract that

Q37: Identify the type of hedge under each

Q40: Princeton Inc.granted 290,000 stock options to its

Q43: Amel Company issues convertible bonds with face

Q50: Which of the following statements is correct?<br>A)Repayment

Q53: What is a "forward"?<br>A)A contract in which

Q70: How is the subsequent conversion of bonds

Q87: Roman Corporation issued call options on 5,000