Essay

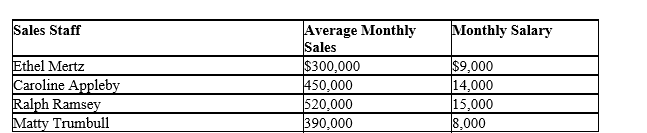

Optimal Input Mix. Puerto Rico-based Chocolate Products, Inc., manufactures and distributes a distinctive line of hand-packed candies. Lucy Ricardo president of Chocolate is reviewing the company's sales-force compensation plan. Currently, the company pays its three experienced sales staff members salaries based on the number of years of service. Matty Trumbull, a new sales trainee, is paid a more modest salary. Monthly sales and salary data for each employee are as follows:

Trumbull in particular has shown great promise during the past year, and Ricardo believes a substantial raise is clearly justified. At the same time, some adjustment to the compensation paid other sales personnel would also seem appropriate. Ricardo is considering changing from the current compensation plan to one based on a 3.5% commission. Ricardo sees such a plan as fairer to the parties involved and believes it would also provide strong incentives for needed market expansion.

Trumbull in particular has shown great promise during the past year, and Ricardo believes a substantial raise is clearly justified. At the same time, some adjustment to the compensation paid other sales personnel would also seem appropriate. Ricardo is considering changing from the current compensation plan to one based on a 3.5% commission. Ricardo sees such a plan as fairer to the parties involved and believes it would also provide strong incentives for needed market expansion.

A. Calculate Chocolate's salary expense for each employee expressed as a percentage of the sales generated by that individual.

B. Calculate monthly income for each employee under a 3.5% commission-based system.

C. Will a commission-based plan result in efficient relative salaries, efficient salary levels, or both?

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Optimal Input Level. U-Do-It Furniture, Inc., sells

Q5: Returns to Scale. Determine whether the following

Q6: The output effect of a proportional increase

Q7: Returns to Scale. Determine whether the following

Q8: Optimal Input Level. Do-It-Yourself, Inc., sells budget-priced

Q10: Right-angle shaped isoquants reflect inputs that are:<br>A)

Q11: The relation between output and the variation

Q12: Marginal revenue product equals:<br>A) marginal revenue multiplied

Q13: Optimal Input Mix. Rachel Green, owner-manager of

Q14: The marginal rate of technical substitution is:<br>A)