Essay

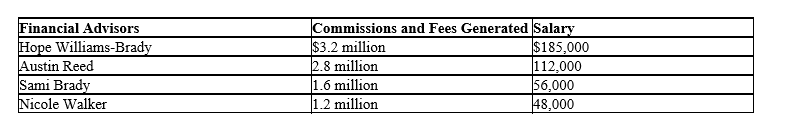

Optimal Input Mix. Salem-based Horton & Brady, Inc., is a small firm offering a wide variety of stock brokerage and financial services to high net worth individuals. Mickey Horton, president of Horton & Brady is reviewing the company's compensation plan. Currently, the company pays its three experienced financial advisors a salary based on the number of years of service. Nicole Walker, a new sales trainee, is paid a more modest salary. Sales and salary data for each employee are as follows:

Walker in particular has shown great promise during the past year, and Horton believes a substantial raise is clearly justified. At the same time, some adjustment to the compensation paid other sales personnel would also seem appropriate. Horton is considering changing from the current compensation plan to one based on a 5% commission. Horton sees such a plan as fairer to the parties involved and believes it would also provide strong incentives for needed market expansion.

A. Calculate Horton & Brady's salary expense for each employee expressed as a percentage of the commissions and fees generated by that individual.

B. Calculate income for each employee under a 5% commission-based system.

C. Will a commission-based plan result in efficient relative salaries, efficient salary levels, or both?

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Optimal Input Level. Communications Consultant Services, Inc.,

Q37: Input Combination. The following production table provides

Q38: Input Combination. The following production table provides

Q39: When MR<sub>Q</sub> = $25, P<sub>X</sub> = $200,

Q40: The law of diminishing returns:<br>A) deals specifically

Q42: Optimal Input Mix. Hydraulics Ltd. has designed

Q43: Optimal Input Level. Just Bikes, Inc., sells

Q44: Returns to Scale. Determine whether the following

Q45: Nonprice Competition. Top Gun Marketing, Inc., offers

Q46: When P<sub>X</sub> = $100, MP<sub>X</sub> = 10