Essay

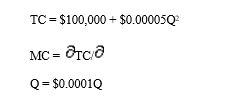

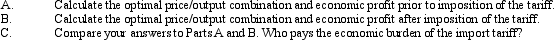

Tariffs. The Manchester Shoe Corporation is an importer and distributor of foreign-made footwear that is sold at popular prices in leading discount retailers. The U.S. Commerce Department recently informed the company that it will be subject to a new 25% tariff on the import cost of rubberized footwear originating from China. The company is concerned that the tariff will slow its sales growth, given the highly competitive nature of the footwear market where wholesale prices are stable at $5 per unit. Relevant total cost (TC) and marginal cost (MC) relations for this product are:

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Competitive Market Equilibrium. Suppose demand and supply

Q29: Outsourcing Tariffs. The Seattle Software Company develops,

Q30: Franchise Tax and Inelastic Demand. Assume the

Q31: Failure by market structure can occur when:<br>A)

Q32: A price ceiling is a costly and

Q34: Above-normal returns earned in the time interval

Q35: A government policy that addresses market failures

Q36: Costs of Regulation. The Appalachian Coal Company

Q37: Competition in the cable television service industry

Q38: The costs of pollution taxes are shared