Essay

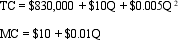

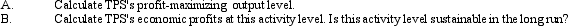

Competitive Strategy. Carry Underwood runs Tax Preparation Services, Inc., a small firm that offers timely tax preparation services in Oklahoma City. Given the large number of competitors, the fact that tax preparers rely heavily upon standard tax-preparation software, and the lack of entry barriers, it is reasonable to assume that the tax form preparation market is perfectly competitive and that the average $150 price equals marginal revenue, P = MR = $150. Assume that TPS's annual operating expenses are typical of several such firms operating in the local market, and can be expressed by the following total and marginal cost functions:

where TC is total cost per year, MC is marginal cost, and Q is the number of clients served. Total costs include a normal profit and allow for Underwood's employment opportunity costs.

where TC is total cost per year, MC is marginal cost, and Q is the number of clients served. Total costs include a normal profit and allow for Underwood's employment opportunity costs.

Correct Answer:

Verified

The Q = 14,000 activity level r...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The Q = 14,000 activity level r...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: A government policy that addresses market failures

Q36: Costs of Regulation. The Appalachian Coal Company

Q37: Competition in the cable television service industry

Q38: The costs of pollution taxes are shared

Q39: Percentage Tax and Inelastic Demand. Assume the

Q41: Recycling Fee and Elastic Demand. Assume that

Q42: Franchise Tax and Inelastic Demand. Assume the

Q43: In competitive market equilibrium, social welfare is

Q44: Producer surplus is the:<br>A) amount paid to

Q45: Profits stemming from market power reflect:<br>A) high