Multiple Choice

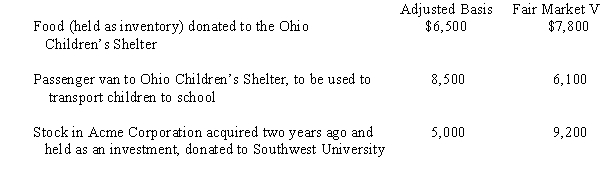

Grocer Services Corporation (a calendar year taxpayer) ,a wholesale distributor of food,made the following donations to qualified charitable organizations during the year:

How much qualifies for the charitable contribution deduction?

A) $21,800.

B) $24,840.

C) $24,100.

D) $22,450.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q71: For a corporation,the domestic production activities deduction

Q72: Maize Corporation had $100,000 operating income and

Q74: Discuss the purpose of Schedule M-1.Give an

Q76: Azul Corporation,a personal service corporation,had $450,000 of

Q77: Beth and Debbie are equal owners in

Q78: On December 31,2008,Lavender,Inc.,an accrual basis C corporation,accrues

Q79: Which of the following statements is correct

Q80: Serena,a cash basis taxpayer,owns 60% of the

Q90: C corporations can elect fiscal years that

Q100: Nicole owns and operates a sole proprietorship.She