Essay

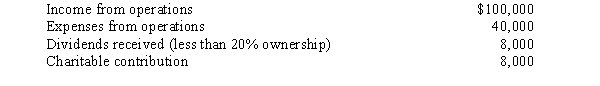

Wallaby,Inc.,a calendar year C corporation,had the following income and expenses in 2008:

A)How much is Wallaby, Inc.'s charitable contribution deduction for 2008?

B)What happens to the portion of the contribution not deductible in 2008?

Correct Answer:

Verified

A.TAXABLE INCOME FOR PURPOSES OF APPLYIN...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Ostrich Corporation has net short-term capital gains

Q9: Which of the following statements is incorrect

Q10: Before paying salaries to its two shareholders,Steamboat

Q12: Egret Corporation,a calendar year taxpayer,had an excess

Q13: Redwood,Inc.,a closely held personal service corporation,has a

Q14: Bjorn owns a 40% interest in an

Q15: Norma formed Hyacinth Enterprises,a proprietorship,in 2008.In its

Q16: A corporate net operating loss can be

Q20: An expense that is deducted in computing

Q56: Compensation that is determined to be unreasonable