Essay

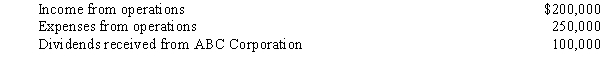

During the year,Quartz Corporation (a calendar year taxpayer)has the following transactions:

Quartz owns 15% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Correct Answer:

Verified

Quartz has an NOL,computed as ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: Schedule M-1 is used to reconcile net

Q52: Elk,a C corporation,has $400,000 operating income and

Q53: Herman and Henry are equal partners in

Q54: Shaw,an architect,is the sole shareholder of Shaw

Q55: Which of the following statements about a

Q56: FIN 48 provides that a tax position

Q59: Pierre is the sole shareholder of Pine

Q60: Zircon Corporation donated scientific property worth $350,000

Q61: Luis is the sole shareholder of Stork,Inc.,a

Q62: During 2008,Sparrow Corporation,a calendar year C corporation,had