Multiple Choice

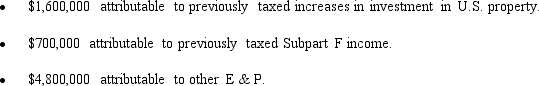

Benchmark,Inc.,a U.S.shareholder owns 100% of a CFC from which Benchmark receives a $3 million cash distribution.The CFC's E & P is composed of the following amounts.

Benchmark recognizes a taxable dividend of:

A) $3 million.

B) $700,000.

C) $2,300,000.

D) $0.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Match the definition with the correct term.<br>a.

Q24: Match the definition with the correct term.<br>-Individual

Q105: Which of the following statements regarding the

Q106: ForCo,a controlled foreign corporation,earns $500,000 in net

Q108: A PFIC is a U.S.-based mutual fund

Q109: Which of the following statements regarding foreign

Q110: Which of the following would not prevent

Q111: U.S.income tax treaties:<br>A)Provide for primary taxation with

Q119: Interest paid to an unrelated party by

Q146: A nonresident alien with U.S.-source income effectively