Essay

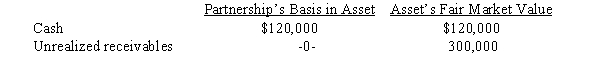

Greg has a 20% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on September 1 of the current year is $300,000.On that date,the partnership liquidates and makes a proportionate distribution of the following assets to Greg.

a.Calculate Greg's recognized gain or loss on the liquidating distribution, if any.

a. change if the partnership also distributed a chair to Greg? Assume the chair has a $500 adjusted basis (FMV is $800) to the partnership.

b.How would your answer to

Correct Answer:

Verified

a.Greg recognizes a $180,000 capital los...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Match the following statements with the best

Q12: Tim receives a proportionate nonliquidating distribution from

Q14: Sarah owns a 30% interest in the

Q17: Susan is a one-fourth limited partner in

Q30: Match the following statements with the best

Q44: Match the following statements with the best

Q93: Match the following statements with the best

Q106: Match the following independent descriptions as hot

Q108: Match each of the following statements with

Q140: Match the following statements with the best