Essay

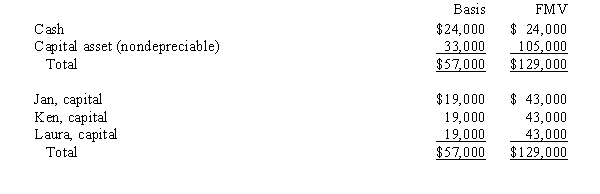

The December 31,2008,balance sheet of the calendar-year JKL Partnership reads as follows.

Each partner shares in 1/3 of the partnership capital,income,gain,loss,deduction and credit.On December 31,2008,Jan sells her 1/3 partnership interest to Jennifer for $43,000 cash.Assume the partnership makes a § 754 election for 2008.

a.What is the amount of Jennifer's "step-up" adjustment under § 743(b)?

b.If the nondepreciable capital asset is sold the next year for $120,000, determine the amount of gain that Jennifer will recognize on her tax return because of the sale.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Match the following independent distribution payments in

Q7: The December 31,2008,balance sheet of the DIP

Q8: Jason sold his 40% interest in the

Q9: Toni's basis in her partnership interest was

Q10: Match the following statements with the best

Q11: Match the following statements with the best

Q13: A partnership has accounts receivable with a

Q19: Match the following statements with the best

Q61: Match the following independent descriptions as hot

Q140: Match the following statements with the best