Short Answer

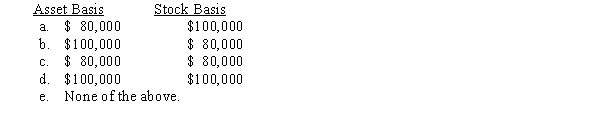

Trolette contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a C corporation and the transaction qualifies under § 351,the corporation's basis for the property and the shareholder's basis for the stock are:

Correct Answer:

Verified

C

Under § 351 the carryover ba...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Under § 351 the carryover ba...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Match the following attributes with the different

Q87: Lime,Inc.,has taxable income of $320,000.If Lime is

Q88: The AMT rate for a C corporation

Q89: From the perspective of the buyer of

Q93: Bart contributes $100,000 to the Tuna Partnership

Q94: If a business entity has a majority

Q95: Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's

Q96: Factors that should be considered in making

Q97: The shareholders of an S corporation all

Q140: Match each of the following statements with