Short Answer

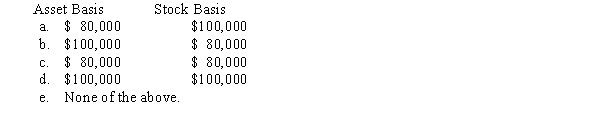

Alanna contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a partnership and the transaction qualifies under § 721,the partnership's basis for the property and the partner's basis for the partnership interest are:

Correct Answer:

Verified

C

Under § 721 the carryover ba...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Under § 721 the carryover ba...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: An S corporation is not subject to

Q46: Match the following statements.<br>-Organization costs<br>A)For the corporate

Q88: Match the following statements.<br>-Net capital gain<br>A)For the

Q129: Bev and Cabel each own one-half of

Q130: Thrush,Inc.,provides group-term life insurance of $50,000 for

Q132: Rebecca and Stan each own a 50%

Q135: The legal form of Amy and Beth's

Q136: A disadvantage of corporations (both C corporations

Q138: Beige,Inc.,has 3,000 shares of stock authorized and

Q139: Lisa is considering investing $25,000 in a