Short Answer

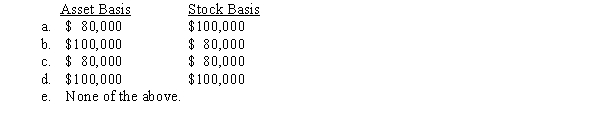

Marcus contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is an S corporation and the transaction qualifies under § 351,the S corporation's basis for the property and the shareholder's basis for the stock are:

Correct Answer:

Verified

C

As § 351 nonrecognition appl...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

As § 351 nonrecognition appl...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: An S corporation election for Federal income

Q67: Ralph wants to purchase either the stock

Q85: If an individual contributes an appreciated personal

Q95: Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's

Q96: Factors that should be considered in making

Q97: The shareholders of an S corporation all

Q99: The tax treatment of S corporation shareholders

Q101: Which of the following statements regarding the

Q104: Tonya contributes $150,000 to Swan,Inc.,for 75% of

Q105: To the extent of built-in gain at