Essay

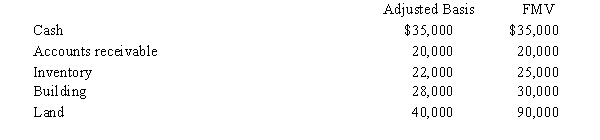

Lee owns all the stock of Vireo,Inc.,a C corporation for which he has an adjusted basis of $150,000.The assets of Vireo,Inc.,are as follows:

Lee sells his stock to Katrina for $200,000.

a.Determine the tax consequences to Lee.

b.Determine the tax consequences to Katrina.

c.Determine the tax consequences to Vireo, Inc.

Correct Answer:

Verified

a.Lee has a recognized gain of $50,000 (...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: A limited partner in a limited partnership

Q33: Actual dividends paid to shareholders result in

Q36: Parrot,Inc.,a C corporation,distributes $50,000 to its shareholder,Jerome,and

Q38: Kirby,the sole shareholder of Falcon,Inc.,leases a building

Q41: Carol is a 60% owner of a

Q42: Match the following statements.<br>-Sale of corporate stock

Q43: In its first year of operations (2008),Auburn,Inc.(a

Q44: Abby is a limited partner in a

Q56: Match the following statements.<br>-Technique for minimizing double

Q100: Match each of the following statements with