Multiple Choice

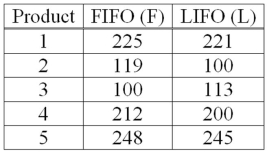

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What are the degrees of freedom?

What are the degrees of freedom?

A) 4

B) 5

C) 15

D) 10

Correct Answer:

Verified

Correct Answer:

Verified

Q29: If the null hypothesis states that there

Q30: For hypotheses that compare two population means,

Q32: What is the critical value of t

Q33: A recent study focused on the amount

Q35: If two dependent samples of size 100

Q36: What is the critical value of t

Q37: A company is researching the effectiveness of

Q37: If two dependent samples of size 20

Q39: When independent samples are used to test

Q60: Two samples,one of size 14 and the