Multiple Choice

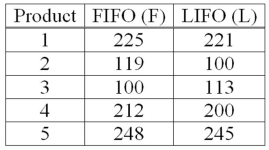

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

A) Fail to reject the null hypothesis and conclude LIFO is more effective.

B) Reject the null hypothesis and conclude LIFO is more effective.

C) Reject the alternate hypothesis and conclude LIFO is more effective.

D) Fail to reject the null hypothesis.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: When dependent samples are used to test

Q67: A national manufacturer of ball bearings is

Q68: When can a paired t-test be used

Q69: An investigation of the effectiveness of a

Q70: When testing for a difference between the

Q71: A national manufacturer of ball bearings is

Q74: If we are testing for the difference

Q75: A recent study focused on the amount

Q76: When testing for a difference between the

Q77: A study by a bank compared the