Multiple Choice

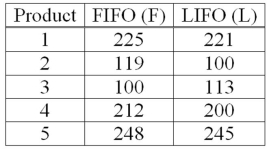

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  This example is what type of test?

This example is what type of test?

A) A one-sample test of means.

B) A two-sample test of means.

C) A paired t-test.

D) A test of proportions.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A company is researching the effectiveness of

Q4: When dependent samples are used to test

Q5: A national manufacturer of ball bearings is

Q6: When testing the null hypothesis that two

Q7: A recent study focused on the number

Q9: If samples taken from two populations are

Q10: A financial planner wants to compare the

Q11: A statistics professor wants to compare grades

Q12: A company is researching the effectiveness of

Q13: A national manufacturer of ball bearings is