Multiple Choice

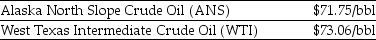

Use the information for the question(s) below.  As an oil refiner, you are able to produce $77 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $78 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude. Another oil refiner is offering to trade you 10,150 bbl of Alaska North Slope (ANS) crude oil for 10,000 bbl of West Texas Intermediate (WTI) crude oil. Assuming you currently have 10,000 bbl of WTI crude, the added benefit (cost) to you if you take the trade is closest to ________.

As an oil refiner, you are able to produce $77 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $78 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude. Another oil refiner is offering to trade you 10,150 bbl of Alaska North Slope (ANS) crude oil for 10,000 bbl of West Texas Intermediate (WTI) crude oil. Assuming you currently have 10,000 bbl of WTI crude, the added benefit (cost) to you if you take the trade is closest to ________.

A) ($1550)

B) $1550

C) ($3475)

D) $3475

Correct Answer:

Verified

Correct Answer:

Verified

Q4: To calculate a cash flow's present value

Q8: Which of the following statements regarding the

Q22: How can we perform a cost-benefit analysis

Q42: A vintner is deciding when to release

Q44: In general, if an action increases a

Q61: Which of the following statements is FALSE

Q61: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2789/.jpg" alt=" Refer to the

Q63: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2789/.jpg" alt="Consider

Q67: What is the present value (PV) of

Q103: A 2013 Toyota Camry can be bought