Multiple Choice

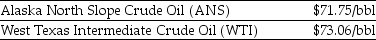

Use the information for the question(s) below.  As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude. Another oil refiner is offering to trade you 10,100 bbl of Alaska North Slope (ANS) crude oil for 9,950 bbl of West Texas Intermediate (WTI) crude oil. Assuming you just purchased 9,950 bbl of WTI crude at the current market price, the total revenue (cost) to you if you take the trade is closest to ________.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude. Another oil refiner is offering to trade you 10,100 bbl of Alaska North Slope (ANS) crude oil for 9,950 bbl of West Texas Intermediate (WTI) crude oil. Assuming you just purchased 9,950 bbl of WTI crude at the current market price, the total revenue (cost) to you if you take the trade is closest to ________.

A) $755,650

B) $766,150

C) $767,600

D) $776,650

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A company intends to install new management

Q33: You are scheduled to receive $10,000 in

Q36: If an arbitrage opportunity exists, an investor

Q40: A firm that provides tax services to

Q48: Dollar amounts received at different points in

Q50: Explain the role played by some of

Q54: Whenever a good trades in a competitive

Q65: The rule of 72 tells you approximately

Q97: Heavy Duty Company, a manufacturer of power

Q104: A metal fabrication company is pricing raw