Multiple Choice

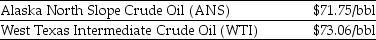

Use the information for the question(s) below.  As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude. Another oil refiner is offering to trade you 10,150 bbl of Alaska North Slope (ANS) crude oil for 10,000 bbl of West Texas Intermediate (WTI) crude oil. Assuming you currently have 10,000 bbl of WTI crude, what should you do?

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude. Another oil refiner is offering to trade you 10,150 bbl of Alaska North Slope (ANS) crude oil for 10,000 bbl of West Texas Intermediate (WTI) crude oil. Assuming you currently have 10,000 bbl of WTI crude, what should you do?

A) Sell 10,000 bbl WTI crude on the market and use the proceeds to purchase and refine ANS crude.

B) Do nothing; refine the 10,000 bbl of WTI crude.

C) Trade the 10,000 bbl WTI crude with the other refiner and refine the 10,150 bbl of ANS crude.

D) Trade the 10,000 bbl WTI crude with the other refiner and then sell the 10,150 bbl of ANS crude.

Correct Answer:

Verified

Correct Answer:

Verified

Q49: Costs and benefits must be put in

Q55: Which of the following statements is INCORRECT

Q56: You own 1000 shares of Newstar Financial

Q68: If the interest rate is 9%, the

Q76: Whenever a good trades in a competitive

Q85: If the one-year discount factor is equal

Q90: The State Bank offers an interest rate

Q93: What is the future value (FV) of

Q94: On the day Harry was born, his

Q99: To compute the future value of a