Multiple Choice

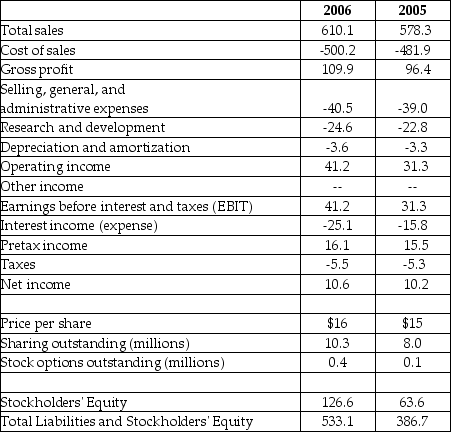

Luther Corporation Consolidated Income Statement

Year ended December 31 (in $millions)  Refer to the income statement above. For the year ending December 31, 2006 Luther's earnings per share is closest to ________.

Refer to the income statement above. For the year ending December 31, 2006 Luther's earnings per share is closest to ________.

A) $0.51

B) $1.03

C) $0.82

D) $1.23

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Allen Company bought a new copy machine

Q40: What will be the effect on the

Q44: The exchanges in which of the following

Q45: Use the table for the question(s) below.<br>AOS

Q52: What is the need for the notes

Q80: Cash is a:<br>A)long-term asset.<br>B)current asset.<br>C)current liability.<br>D)long-term liability.

Q90: Luther Corporation Consolidated Income Statement<br>Year ended December

Q91: Luther Corporation Consolidated Balance Sheet<br>December 31, 2006

Q92: Luther Corporation Consolidated Balance Sheet<br>December 31, 2006

Q93: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2789/.jpg" alt=" Above are portions