Multiple Choice

TABLE 9.1

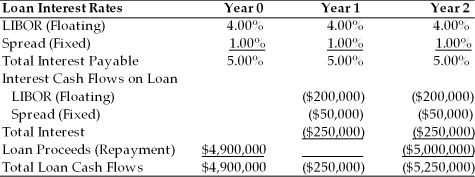

Use the information for Polaris Corporation to answer following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 9.1. What is the all-in-cost (i.e., the internal rate of return) of the Polaris loan including the LIBOR rate, fixed spread and upfront fee?

A) 4.00%

B) 5.00%

C) 5.53%

D) 6.09%

Correct Answer:

Verified

Correct Answer:

Verified

Q21: The potential exposure that any individual firm

Q23: Credit risk is the risk of changes

Q24: Instruction 9.1:<br>For the following problem(s), consider these

Q26: Historically, interest rate movements have shown less

Q27: LIBOR is an acronym for<br>A)Latest Interest Being

Q30: Instruction 9.1:<br>For the following problem(s), consider these

Q33: Instruction 9.1:<br>For the following problem(s), consider these

Q35: An interbank-traded contract to buy or sell

Q40: Unlike the situation with exchange rate risk,

Q48: A basis point is one-tenth of one