Multiple Choice

TABLE 9.1

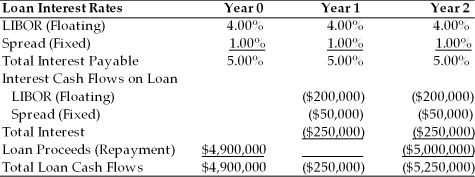

Use the information for Polaris Corporation to answer following question(s) .

Polaris is taking out a $5,000,000 two-year loan at a variable rate of LIBOR plus 1.00%. The LIBOR rate will be reset each year at an agreed upon date. The current LIBOR rate is 4.00% per year. The loan has an upfront fee of 2.00%

-Refer to Table 9.1. What portion of the cost of the loan is at risk of changing?

A) the LIBOR rate

B) the spread

C) the upfront fee

D) all of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q15: An agreement to swap a fixed interest

Q23: Your firm is faced with paying a

Q25: Some of the world's largest and most

Q31: A firm with fixed-rate debt that expects

Q40: The following would be an example of

Q42: Instruction 9.1:<br>For the following problem(s), consider these

Q43: Instruction 9.1:<br>For the following problem(s), consider these

Q45: Swap rates are derived from the yield

Q47: _ is the potential exposure any individual

Q49: A firm enters into a swap agreement