Essay

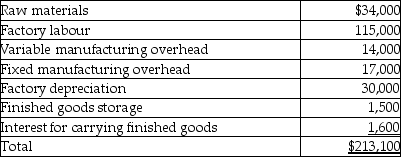

Comfy Feet manufactures slippers. In 2011, the company hired a new bookkeeper who did not have appropriate training. The bookkeeper charged all of the following costs for manufacturing 70,000 pairs of slippers to "Production Expense."

The company had zero work-in-process at the end of both 2010 and 2011. Finished goods amounted to 20,000 pairs at $9.00 per pair at the end of 2010. There were 6,500 pairs in finished goods inventory at the end of 2011.

The company had zero work-in-process at the end of both 2010 and 2011. Finished goods amounted to 20,000 pairs at $9.00 per pair at the end of 2010. There were 6,500 pairs in finished goods inventory at the end of 2011.

Required:

a. Provide the adjusting journal entry or entries at Dec 31, 2011 to correct the bookkeeper's errors and properly record the above expenditures recorded in the "Production Expense" account.

b. Assume the company uses a periodic inventory system and the FIFO cost flow assumption for finished goods. Calculate the cost of goods sold and the ending value of finished goods inventory for the year 2011.

c. Now assume the company uses the weighted-average cost flow assumption. Calculate the cost of goods sold and the ending value of finished goods.

Correct Answer:

Verified

a. The costs related to production shoul...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: What issues arise on the initial recognition

Q97: Which statement best explains the FIFO cost

Q110: Use the chart provided below to determine

Q112: Identify whether the following are benefits of

Q113: Assume that ending inventory in fiscal 2012

Q117: Assume that a $500 purchase invoice received

Q120: Assume that ending inventory in fiscal 2012

Q129: Which statement is correct about the specific

Q139: Explain what problems are created for the

Q152: Explain what happens if the value of