Essay

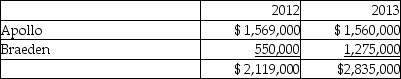

Kryan Corp. mines and produces aluminum. During 2012, the company explored two new sites and evaluated them for aluminum ore potential. By the December 31, 2012 year-end, both sites remained in the evaluation stage. During 2013, evaluation of site Apollo was completed and the site was deemed to have sufficient quantities of ore; consequently, development of the site began. However, site Braeden was determined to have ore concentrations too low to be commercially viable. The following is the cost of exploration and evaluation incurred on the two sites:

Required:

Required:

Record the journal entries in 2012 and 2013 relating to the exploration and evaluation costs using the successful efforts method. Assume that Kryan has a policy of capitalizing the costs of exploration and evaluation.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Which statement is correct?<br>A)Capitalization of costs ceases

Q29: Which of the following is a difference

Q40: Explain the accounting for internally developed intangible

Q47: How does IFRS require that government grants

Q51: Which statement is correct?<br>A)In the exploration phase,

Q59: What is the appropriate treatment for re-payment

Q59: Patent Corp., a publicly accountable entity, incurred

Q60: GoodResources incurred the following costs: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2820/.jpg"

Q63: Which statement is correct?<br>A)Under IFRS, research costs

Q68: Calculate the missing amounts by completing the