Essay

The following transactions occurred in fiscal 2012:

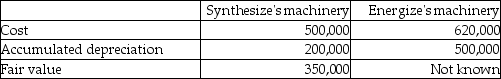

•Synthesize Inc. exchanged machinery with Energize Corp.

•Synthesize Inc. purchased equipment by signing a 5 year non-interest bearing note payable for $200,000. The implicit rate of interest was 5%.

•Synthesize Inc. purchased equipment by signing a 5 year non-interest bearing note payable for $200,000. The implicit rate of interest was 5%.

•Synthesize received a government grant of $10,000 to help purchase the equipment.

Required:

a)Assuming the machinery exchange has commercial substance, prepare the required journal entries for the exchange for both Synthesize and Energize.

b)Assuming the machinery exchange does not have commercial substance, prepare the required journal entries for the exchange for both Synthesize and Energize.

c)Prepare the required journal entry to record the purchase of the equipment purchased by the non-interest bearing note.

d)Prepare the required journal entries to record the government grant using both the gross method and the net method.

Correct Answer:

Verified

a)Assuming the machinery exchange has co...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: Which statement describes the "full cost" method?<br>A)A

Q49: Patent Corp., a publicly accountable entity, purchased

Q50: Kryan Corp. mines and produces aluminum. During

Q51: Soorya Resources incurred the following costs: <img

Q52: Soorya Resources incurred the following costs: <img

Q56: New Ventures Corp., a publicly accountable entity,

Q57: New Ventures Corp., a publicly accountable entity,

Q58: SuperIdeas Corp, a publicly accountable entity, incurred

Q59: Patent Corp., a publicly accountable entity, incurred

Q73: Which statement is correct?<br>A)In the exploration and