Multiple Choice

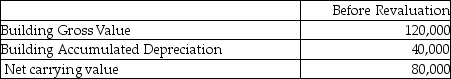

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $20,000. What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the proportional method to record the revaluation?

The fair value for the property is $20,000. What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the proportional method to record the revaluation?

A) $0

B) $30,000 debit

C) $30,000 credit

D) $60,000 debit

Correct Answer:

Verified

Correct Answer:

Verified

Q21: Company One purchased land for $900,000 some

Q31: Which statement is not correct?<br>A)Accounting for biological

Q32: Which of the following is correct with

Q50: Which is correct with respect to the

Q58: Which statement is correct about using the

Q63: Smith Inc wishes to use the revaluation

Q67: Based on the following information, what is

Q71: Company Twelve purchased land for $900,000 some

Q82: When is a "disposal group" classified as

Q103: Which of the following is correct with