Multiple Choice

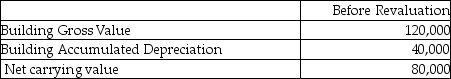

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $40,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

The fair value for the property is $40,000. Assuming this is the first year of using the revaluation model, which of the following amounts will be booked?

A) $40,000 debit to profit and loss

B) $40,000 credit to profit and loss

C) $40,000 debit to OCI

D) $40,000 credit to OCI

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following is correct with

Q5: Which statement is not correct?<br>A)Impairment testing is

Q6: Which of the following is correct with

Q41: Stay Dry Raincoats uses three different machines

Q42: Wallace Inc wishes to use the revaluation

Q42: How is a revaluation loss on non-current

Q44: Grover Inc wishes to use the revaluation

Q47: Wilson Inc wishes to use the revaluation

Q51: What impairment, if any, exists on this

Q69: Explain how non-current assets that are held