Multiple Choice

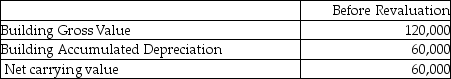

Smith Inc wishes to use the revaluation model for this property:  The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $150,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

A) $12,000 debit

B) $12,000 credit

C) $30,000 credit

D) $30,000 debit

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Where are gains and losses on agricultural

Q28: The following information is available about Fred

Q29: Adam's Bikes produces specialized bicycle frames. The

Q31: The following information is available about George

Q36: Based on the following information, what is

Q38: What impairment, if any, exists on these

Q77: Explain the accounting for assets related to

Q78: What is "fair value"?<br>A)The present value of

Q84: Which is an exception to the rule:

Q98: Explain how non-current assets such as definite