Multiple Choice

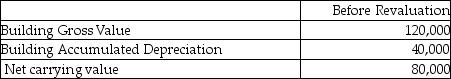

Wallace Inc wishes to use the revaluation model for this property:  The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $60,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

A) $12,000 debit

B) $12,000 credit

C) $16,000 credit

D) $16,000 debit

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Explain why non-current assets held for sale

Q55: On December 31, 2012, CA Inc. had

Q56: Compare the proportional method and the elimination

Q59: Grover Inc wishes to use the revaluation

Q61: Grover Inc wishes to use the revaluation

Q62: Information about the PPE for Jeffery Inc.

Q74: How should a discontinued operation be presented

Q91: What is "fair value less costs to

Q115: What information is not necessary about discontinued

Q119: Which statement is not correct?<br>A)Biological assets are