Multiple Choice

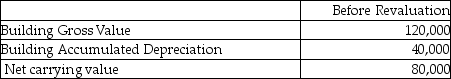

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

A) $16,000 debit

B) $16,000 credit

C) $28,000 credit

D) $28,000 debit

Correct Answer:

Verified

Correct Answer:

Verified

Q4: When should an entity select the exception

Q8: Wilson Inc wishes to use the revaluation

Q10: Reid Resch is a maker of instruments

Q14: Explain the meaning of biological assets and

Q39: Which statement describes the "historical cost model"?<br>A)A

Q46: What are "costs of disposal"?<br>A)The incremental costs

Q60: Company Nine purchased land for $600,000 some

Q76: Which statement is correct?<br>A)Agricultural activity relates to

Q109: Which statement is correct?<br>A)The revaluation model is

Q120: How is an impairment loss allocated to