Essay

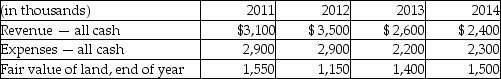

Wright Now Limited (WNL)was incorporated on January 1, 2011 when the sole shareholder invested $7,500,000. This is the only financing the firm needed. WNL used $1,200,000 of the funds to purchase land. The company has a single project that it developed over four years. Below are details of the four years of operations. At the end of 2014 the land was sold for its fair value.

Required:

Required:

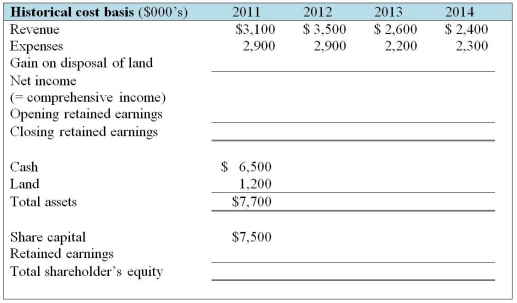

Complete the following table, assuming that WNL uses the historical cost basis of measurement.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Company Ten purchased land for $400,000 during

Q81: When does an entity use the "cost

Q89: Based on the following information, what is

Q89: Which of the following is correct with

Q90: What impairment, if any, exists on these

Q90: Explain why non-current assets held for sale

Q92: Smith Inc wishes to use the revaluation

Q94: Based on the following information, what is

Q95: Based on the following information, what is

Q96: When does agricultural activity end?<br>A)To point just