Multiple Choice

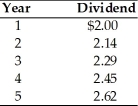

A firm has common stock with a market price of $55 per share and an expected dividend of $2.81 per share at the end of the coming year. The dividends paid on the outstanding stock over the past five years are as follows:  The cost of the firm's common stock equity is ________.

The cost of the firm's common stock equity is ________.

A) 4.1 percent

B) 5.1 percent

C) 12.1 percent

D) 15.4 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q120: The cost of common stock equity may

Q121: When the constant-growth valuation model is used

Q122: From a bond issuer's perspective, the IRR

Q123: The amount of preferred stock dividends that

Q124: What would be the cost of retained

Q126: The cost to maturity of existing bonds

Q127: Given that the cost of common stock

Q128: The cost of capital reflects the cost

Q129: The specific cost of each source of

Q130: A firm has determined its cost of