Multiple Choice

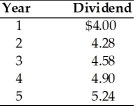

A firm has common stock with a market price of $100 per share and an expected dividend of $5.61 per share at the end of the coming year. A new issue of stock is expected to be sold for $98, with $2 per share representing the underpricing necessary in the competitive capital market. Flotation costs are expected to total $1 per share. The dividends paid on the outstanding stock over the past five years are as follows:  The cost of this new issue of common stock is ________.

The cost of this new issue of common stock is ________.

A) 5.8 percent

B) 7.7 percent

C) 10.8 percent

D) 12.8 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q107: Target weights are either book value or

Q108: A corporation has concluded that its financial

Q109: The cost of preferred stock is the

Q110: The cost of capital acts as a

Q111: One measure of the cost of common

Q113: Target weights are either book value or

Q114: A firm can retain more of its

Q115: In general, floatation costs include two components,

Q116: Table 9.2<br>A firm has determined its optimal

Q117: Historical weights are the present value of