Multiple Choice

Table 9.1

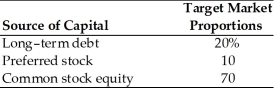

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-The firm's cost of a new issue of common stock is ________. (See Table 9.1)

A) 7 percent

B) 9.08 percent

C) 14.2 percent

D) 13.4 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q33: The before-tax cost of debt for a

Q34: In using the cost of capital, it

Q35: Debt is generally the least expensive source

Q36: Using the capital asset pricing model, the

Q37: A firm has common stock with a

Q39: Tangshan Mining is considering issuing long-term debt.

Q40: Flotation costs reduce the net proceeds from

Q41: Table 9.3<br>Balance Sheet<br>General Talc Mines<br>December 31, 2014

Q42: Holding risk constant, the implementation of projects

Q43: The cost of common stock equity may