Multiple Choice

Table 9.1

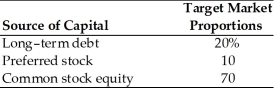

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-If the target market proportion is reduced to 15 percent, what will be the revised weighted average cost of capital? (See Table 9.1)

A) 13.6 percent

B) 11.0 percent

C) 12.34 percent

D) 10.4 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q100: Since retained earnings is a more expensive

Q101: The cost of retained earnings is generally

Q102: What is the dividend on an 8

Q103: Table 9.2<br>A firm has determined its optimal

Q104: The cost of retained earnings will always

Q106: Table 9.1<br>A firm has determined its optimal

Q107: Target weights are either book value or

Q108: A corporation has concluded that its financial

Q109: The cost of preferred stock is the

Q110: The cost of capital acts as a