Multiple Choice

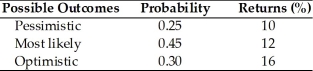

The expected value and the standard deviation of returns for asset A is ________. (See below.) Asset A

A) 12 percent and 4 percent

B) 12.7 percent and 2.3 percent

C) 12.7 percent and 4 percent

D) 12 percent and 2.3 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q168: Returns from internationally diversified portfolios tend to

Q169: The risk of a portfolio containing international

Q170: The capital asset pricing model (CAPM) links

Q171: Unsystematic risk _.<br>A) does not change<br>B) can

Q172: For a risk-indifferent manager, no change in

Q174: A common approach of estimating the variability

Q175: Adam wants to determine the required return

Q176: The expected value, standard deviation of returns,

Q177: A financial manager's goal for the firm

Q178: In general, the lower the correlation between