Multiple Choice

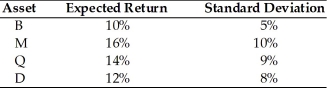

Given the following expected returns and standard deviations of assets B, M, Q, and D, which asset should the prudent financial manager select?

A) Asset B

B) Asset M

C) Asset Q

D) Asset D

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q178: In general, the lower the correlation between

Q179: Table 8.2<br>You are going to invest $20,000

Q180: Higher the coefficient of variation, the greater

Q181: Interest rate risk is the chance that

Q182: Combining two assets having perfectly positively correlated

Q184: Lower the coefficient of variation, the greater

Q185: A normal probability distribution is an asymmetrical

Q186: Which of the following is true of

Q187: The required return on an asset is

Q188: Strikes, lawsuits, regulatory actions, or the loss