Essay

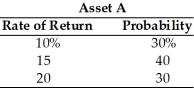

Assuming the following returns and corresponding probabilities for asset A, compute its standard deviation and coefficient of variation.

Correct Answer:

Verified

SD = 3.87...

SD = 3.87...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q161: Even if assets are not negatively correlated,

Q162: Table 8.3<br>Consider the following two securities X

Q163: For a risk-averse manager, the required return

Q164: The interest rate risk associated with Treasury

Q165: War, inflation, and the condition of the

Q167: Two assets whose returns move in the

Q168: Returns from internationally diversified portfolios tend to

Q169: The risk of a portfolio containing international

Q170: The capital asset pricing model (CAPM) links

Q171: Unsystematic risk _.<br>A) does not change<br>B) can