Essay

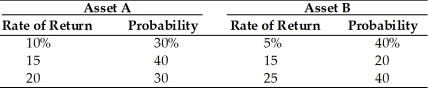

Champion Breweries must choose between two asset purchases. The annual rate of return and related probabilities given below summarize the firm's analysis.  For each asset, compute

For each asset, compute

(a) the expected rate of return.

(b) the standard deviation of the expected return.

(c) the coefficient of variation of the return.

(d) Which asset should Champion select?

Correct Answer:

Verified

(a)  Expected Return = 15% Expected Retu...

Expected Return = 15% Expected Retu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q57: The higher an asset's beta, _.<br>A) the

Q58: Risk aversion is the behavior exhibited by

Q59: If you expect the market to increase

Q60: An efficient portfolio is defined as _.<br>A)

Q61: Changes in risk aversion, and therefore shifts

Q63: A beta coefficient of 0 represents an

Q64: The inclusion of assets from countries that

Q65: A beta coefficient of -1 represents an

Q66: As any investor can create a portfolio

Q67: An increase in the Treasury Bill rate