Essay

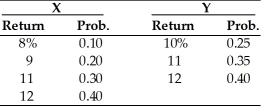

Given the following probability distribution for assets X and Y, compute the expected rate of return, variance, standard deviation, and coefficient of variation for the two assets. Which asset is a better investment?

Correct Answer:

Verified

Expected value = 10.7% Expect...

Expected value = 10.7% Expect...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Akai has a portfolio of three assets.

Q81: _ is the extent of an asset's

Q82: Systematic risk is that portion of an

Q83: The creation of a portfolio by combining

Q84: In the capital asset pricing model, the

Q86: Beta coefficient is an index of the

Q87: An efficient portfolio is a portfolio that

Q88: Tangshan Antiques has a beta of 1.40,

Q89: A(n) _ distribution shows all possible outcomes

Q90: Table 8.2<br>You are going to invest $20,000