Multiple Choice

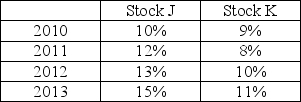

Given the returns of two stocks J and K in the table below over the next 4 years. Find the expected return and standard deviation of holding a portfolio of 40% of stock J and 60% in stock K over the next 4 years:

A) 10.7% and 1.34%

B) 10.6% and 1.79%

C) 10.6% and 1.16%

D) 14.3% and 2.02%

Correct Answer:

Verified

Correct Answer:

Verified

Q37: The difference between the return on the

Q38: Unsystematic risk is the relevant portion of

Q39: Nico wants to invest all of his

Q40: Two assets whose returns move in the

Q41: Investors should recognize that betas are calculated

Q43: Table 8.1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2929/.jpg" alt="Table 8.1

Q44: The simplest type of probability distribution is

Q45: The security market line is not stable

Q46: In the most basic sense, risk is

Q47: The steeper the slope of the security