Multiple Choice

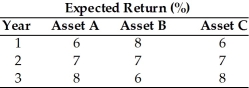

Table 8.1

-If you were to create a portfolio designed to reduce risk by investing equal proportions in each of two different assets, which portfolio would you recommend? (See Table 8.1)

A) Assets A and B

B) Assets A and C

C) none of the available combinations

D) cannot be determined

Correct Answer:

Verified

Correct Answer:

Verified

Q112: The term "risk" is used interchangeably with

Q113: The total rate of return on an

Q114: In the capital asset pricing model, the

Q115: In U.S., during the past 75 years,

Q116: Standard deviation is a measure of relative

Q118: Dr. Dan is considering investment in a

Q119: Tangshan China's stock is currently selling for

Q120: Risk that affects all firms is called

Q121: Investment A guarantees its holder $100 return.

Q122: Tim purchased a bounce house one year