Multiple Choice

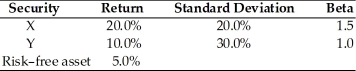

Table 8.3

Consider the following two securities X and Y.

-Using the data from Table 8.3, what is the systematic risk for a portfolio with two-thirds of the funds invested in X and one-third invested in Y?

A) 0.88

B) 1.17

C) 1.33

D) 1.67

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q24: The risk of an asset can be

Q25: Nico owns 100 shares of Stock X

Q27: For a risk-averse manager, required return would

Q28: The _ describes the relationship between nondiversifiable

Q30: Relevant portion of an asset's risk attributable

Q31: The inclusion of assets from countries with

Q32: A beta coefficient of +1 represents an

Q33: Which of the following is true of

Q34: A(n) _ portfolio maximizes return for a

Q61: The _ the coefficient of variation, the