Multiple Choice

Table 8.3

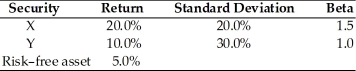

Consider the following two securities X and Y.

-Using the data from Table 8.3, what is the portfolio expected return and the portfolio beta if you invest 35 percent in X, 45 percent in Y, and 20 percent in the risk-free asset?

A) 12.5%, 0.975

B) 12.5%, 1.975

C) 15.0%, 0.975

D) 15.0%, 1.975

Correct Answer:

Verified

Correct Answer:

Verified

Q3: On average in U.S., during the past

Q4: Perry purchased 100 shares of Ferro, Inc.

Q5: An example of an external factor that

Q6: Standard deviation measures the dispersion of an

Q7: The CAPM uses standard deviation to relate

Q9: The standard deviation of a portfolio is

Q10: An efficient portfolio is one that _.<br>A)

Q11: Nicole holds three stocks in her portfolio:

Q12: The widely shared expectations of hard times

Q13: The purpose of adding an asset with