Multiple Choice

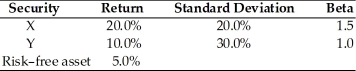

Table 8.3

Consider the following two securities X and Y.

-Using the data from Table 8.3, what is the portfolio expected return if you invest 100 percent of your money in X, borrow an amount equal to half of your own investment at the risk-free rate and invest your borrowings in asset X?

A) 15.0%

B) 22.5%

C) 25.0%

D) 27.5%

Correct Answer:

Verified

Correct Answer:

Verified

Q93: Under no circumstances, adding assets to a

Q94: _ is a statistical measure of the

Q95: A _ measures the dispersion around the

Q96: The beta of a portfolio _.<br>A) is

Q97: Assuming a risk-free rate of 8 percent

Q99: Systematic risk is also referred to as

Q100: Last year, Mike bought 100 shares of

Q101: Diversified investors should be concerned solely with

Q102: If a manager prefers a higher return

Q103: The _ of a given outcome is